Especialistas em digitalização de processos de vendas de seguros

Transforme sua plataforma de vendas em uma vantagem competitiva

Transforme sua plataforma de vendas em uma vantagem competitiva

Aceleração digital

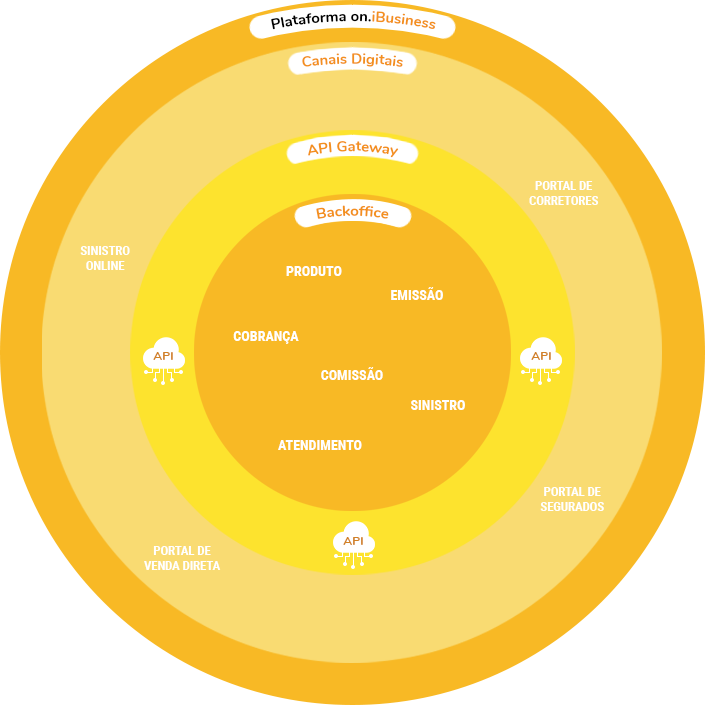

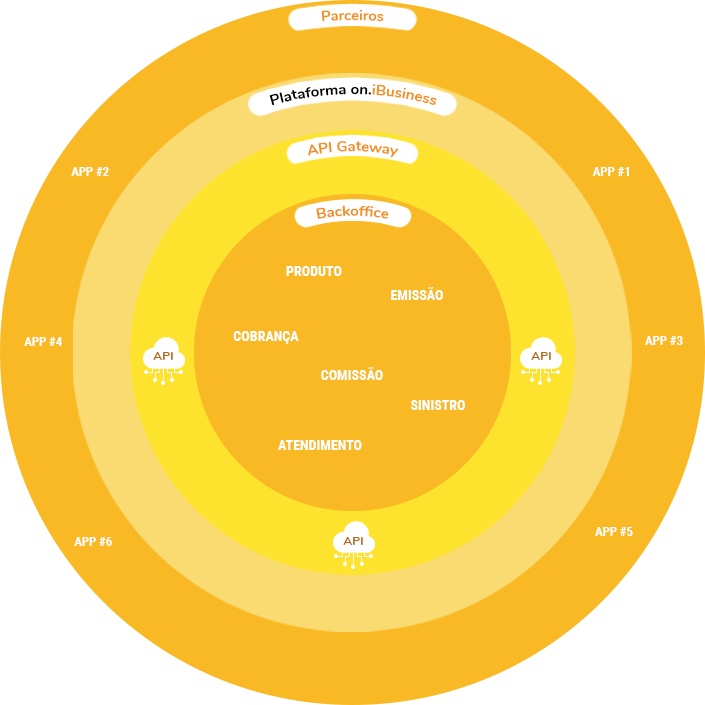

Nossa plataforma on.iBusiness foi criada para acelerar estratégias de vendas de seguros multicanais, entregando produtos de seguros digitais com a melhor experiência e performance do mercado.

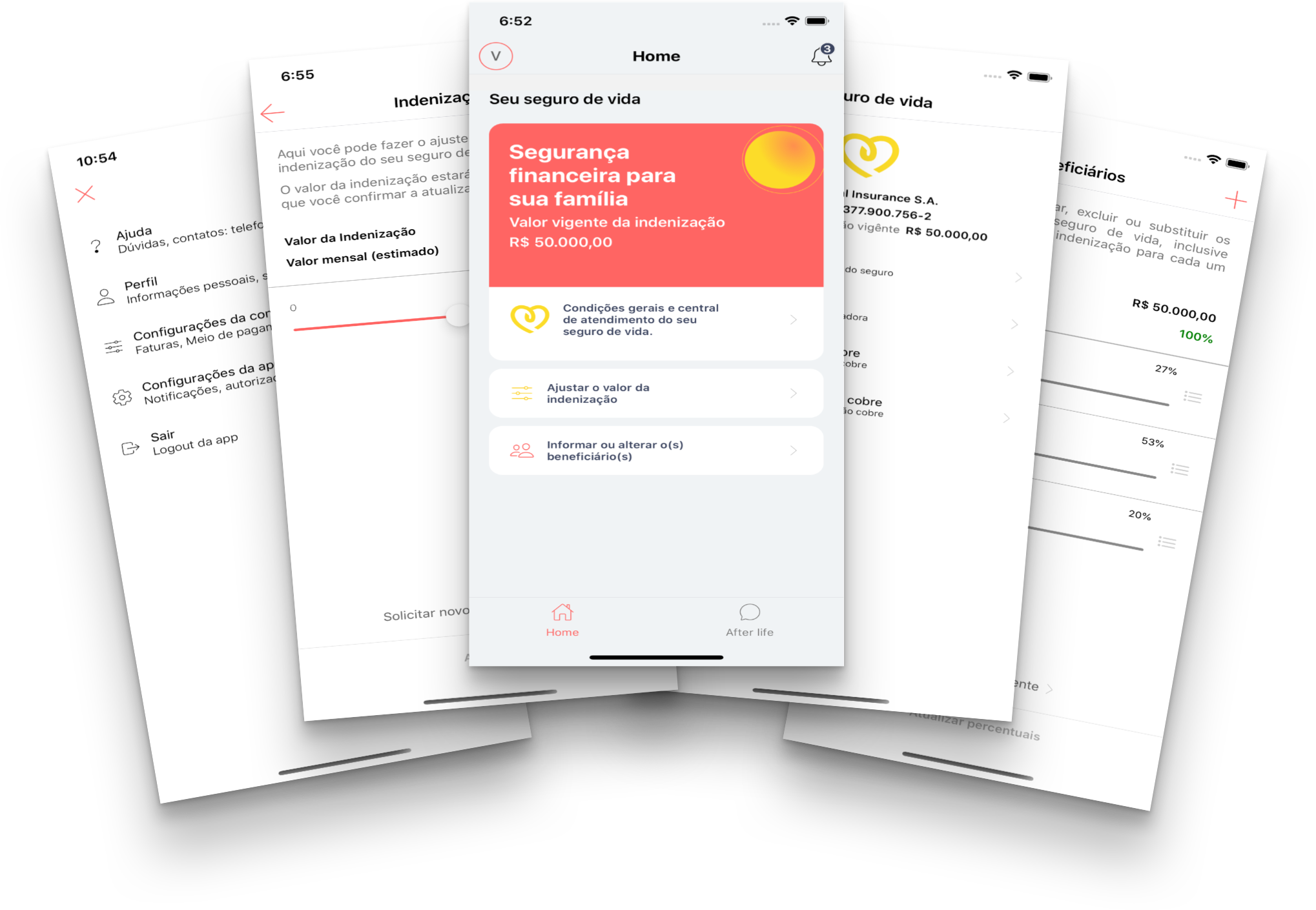

Entregamos uma jornada digital end-to-end para corretores e segurados.

Diversos ramos/produtos com esteiras já predefinidas na plataforma. Além da possibilidade de criação de produtos qualquer ramo.

Workflow eletrônico para cotações (precificação e análise de risco) personalizadas.

Ferramentas dos canais são responsivas para dispositivos móveis.

Plataforma 100% hospedada em cloud.

Em conformidade com as resoluções SUSEP 294/359 de meios remotos.

Open Insurance

Um produto configurado na plataforma on.iBusiness está automaticamente habilitado para ser acessado via API.

Banking for Insurance

Conta digital exclusiva para o corretor, sem taxas, sem burocracia

Gateway de pagamentos 2.0:

registro de boletos online, integração com pagamentos instantâneos (PIX), cartão de crédito, debito em conta

conciliação em tempo real

Emissão da apólice confirmada? Comissão na conta do corretor, on-line na hora

Adiantamento de comissão:

Extrato de comissão com possibilidade de adiantamento de comissão, on-line na hora

Pagamento de contas com cashback, on-line na hora

Split de comissão entre corretor e produtores

Contato

Entre em contato, teremos prazer em te ajudar.

contato@vayon.com.br

Telefones: +55 11 3459-7610

+55 11 97690-0274 (whatsapp)

Endereço: Rua Doutor Candido Espinheira, 560 - 1º andar

Perdizes - São Paulo - SP - CEP: 05004-000